Build a Customer Acquisition Cost Calculator That Drives Growth

If you're just dividing your total marketing spend by your new customers, you're not calculating a metric—you're getting a vanity number. A strategic CAC calculator, on the other hand, is a different beast entirely. It dives deep, tracks costs by channel, and actually informs your budget. It highlights what’s working, what isn’t, and gives you the confidence to scale without guessing.

Why a Generic CAC Formula Is Holding Your Business Back

Most businesses get stuck on that simple formula: total marketing and sales costs divided by new customers. It's clean and easy, but it gives you a blended number that’s often dangerously misleading. This approach treats a customer from a high-intent Google search the same as one from a cold outreach campaign, which we all know is never the case.

This surface-level math can't answer the questions that actually drive growth. Which channel brings in your best customers? Is your content marketing a long-term asset or just a sunk cost? A generic formula papers over these crucial details, making it impossible to double down on your winners or cut the dead weight.

The Rising Stakes of Acquisition Costs

Getting your numbers right isn't just "good practice" anymore—it’s a survival tactic. Acquisition costs have been on a steep climb for years. Multiple analyses show a staggering 222% increase in CAC between 2013 and 2025, driven by crowded ad platforms and fierce competition for attention.

Think about it this way: the average loss on a new customer acquisition jumped from $9 in 2013 to roughly $29 in 2025. That means businesses are paying a lot more just to get someone in the door. If you want to dive deeper, you can find more insights in these customer acquisition cost statistics.

A true customer acquisition cost calculator isn't just a formula in a spreadsheet; it's a strategic tool that transforms your marketing from a perceived cost into a predictable growth engine.

When you move beyond the basic math, you gain the clarity to make smarter bets. It empowers you to:

- Allocate Budgets Intelligently: You can finally pinpoint your most profitable channels and pour resources where they’ll generate the highest return. No more spreading your budget thin and hoping for the best.

- Scale with Confidence: When you know the precise cost to acquire a customer, you have the data to grow predictably. You can hit the accelerator without worrying if you’re driving off a cliff.

- Improve Your Overall Strategy: A granular view of your marketing performance helps you refine everything—your messaging, your targeting, and your offers—for better results across the board.

Ultimately, a detailed calculator gives you a clear, actionable snapshot of your company's financial health and growth potential. It shifts the conversation from "How much did we spend?" to "What did our money buy us?"—and for any scaling business, that's the only question that matters.

Nailing Down the Numbers for a CAC You Can Actually Trust

Your CAC calculator is only as good as the numbers you put into it. It’s the classic "garbage in, garbage out" problem. If you want a figure that’s solid enough to base your budget on, you have to look beyond the obvious line items and hunt down every single cost tied to winning a new customer.

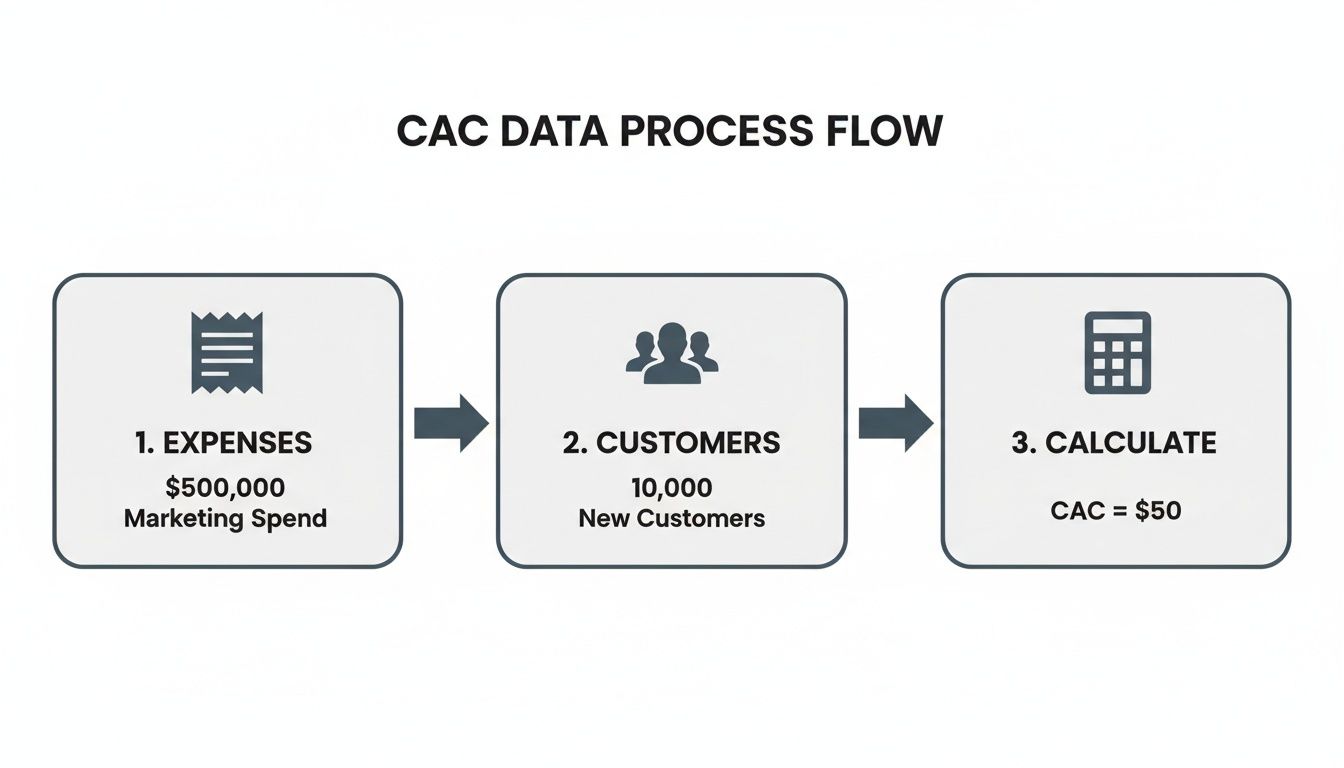

A truly accurate CAC comes down to two things: your total marketing and sales spend, and the number of new customers you won in that same timeframe. Let’s break down how to get these numbers right, because the details are where most people trip up.

Tallying Up Your Real Marketing and Sales Costs

This is the big one. Most businesses just count their ad spend, pat themselves on the back, and call it a day. That's not CAC; it's a vanity metric. To get a real number, you need a complete list of every dollar you spent to attract and convert leads.

Think beyond just the campaign budget. Your actual costs are a mix of direct expenses and the often-overlooked overhead that keeps your growth engine running.

- Salaries and Wages: This is the hidden cost that sinks most calculations. You have to include the prorated salaries of your marketing and sales teams. If someone on your team spends 50% of their time finding new business, then 50% of their salary goes into your CAC. Tools like Deel are great for managing payroll and getting a clear view of these costs.

- Software and Tool Subscriptions: Time to add up all those monthly subscriptions. We're talking about your CRM (like Brevo), your sales intelligence platform (like Apollo), email marketing tools, analytics software—everything.

- Content and Creative Costs: Did you pay a freelance writer for a blog post? Hire a designer for ad creative? Those expenses all belong here. Every dollar spent producing articles, videos, and case studies is part of the acquisition journey.

- Agency and Contractor Fees: This one’s easy to forget but often significant. If you’re working with a marketing agency, an SEO consultant, or a paid media specialist, their retainers are a direct acquisition cost. Don't leave them out.

When you account for everything from salaries to software, you stop looking at a flimsy campaign metric and start seeing a real financial indicator. This is the bedrock of a CAC calculator you can actually rely on.

Defining What a "New Customer" Really Means

Once you’ve got your total costs locked down, you need to count how many new customers you actually acquired during that same period. This sounds simple, but it’s a critical step. What exactly is a new customer? Is it someone who signed up for a free trial, or someone who gave you their credit card?

For your CAC to mean anything, a new customer must be someone who has generated revenue for the first time.

If you count free trial sign-ups as "new customers," you'll artificially deflate your CAC and get a dangerously false sense of security.

The timeline has to be airtight, too. If you’re pulling your costs from January, your customer count must also be from January. This alignment is non-negotiable. It’s what proves the direct link between what you spent and what you got. Misaligning these windows is a rookie mistake that makes the final number completely useless for making decisions.

How To Build Your Calculator in a Spreadsheet

Alright, time to roll up our sleeves and actually build this thing. Putting together a customer acquisition cost calculator in a spreadsheet is much simpler than it sounds, and it's the bridge between abstract numbers and a tool you can use to make real decisions.

The goal here isn't just to dump numbers into cells. We're building a living document—something that’s easy to update, read, and understand at a glance. Let’s open up your spreadsheet tool of choice and get started.

Structuring Your Spreadsheet for Clarity

A logical layout is everything. Don't just throw all your data onto one massive sheet. That's a recipe for confusion and mistakes down the road.

I recommend a simple three-tab structure to keep your data clean and your formulas safe.

- Inputs Tab: This is where you'll manually enter your raw data each month. Think of it as your logbook. Create columns for each expense category we covered: Salaries, Ad Spend, Software Costs, and Contractor Fees. You'll also need a cell for the "Total New Customers Acquired."

- Calculation Tab: This is the engine room. This sheet will pull data from your Inputs tab and do the math. By keeping formulas separate, you prevent anyone from accidentally deleting or overwriting them.

- Dashboard Tab: This is where you visualize your results. A few simple charts tracking CAC over time can help you spot trends instantly without having to squint at rows of numbers.

This setup gives you a clean, high-level view of the process.

This flow really highlights the simple but powerful relationship between what you spend, who you acquire, and the final cost.

Essential Inputs for Your CAC Calculator

To get a truly comprehensive view of your acquisition costs, you need to be thorough about what you include. This table breaks down the key marketing and sales expenses you absolutely should be tracking.

| Expense Category | Specific Examples | Why It's Important |

|---|---|---|

| Salaries & Wages | Marketing manager salary, sales team commissions, content writer pay | This is often the largest single expense. Ignoring it gives you a wildly inaccurate and overly optimistic CAC. |

| Ad Spend | Google Ads, LinkedIn Ads, Facebook Ads, sponsored content | The most direct acquisition cost. Tracking this shows you the immediate ROI on your paid campaigns. |

| Software & Tools | CRM (e.g., HubSpot), analytics platforms, email marketing tools | These tools are the backbone of modern marketing and sales operations; their costs are part of acquiring customers. |

| External Help | Freelance designers, SEO consultants, agency retainers | Any outside help you hire to drive growth is a direct acquisition expense and must be included. |

Getting these inputs right is the foundation of an accurate CAC. Don't be tempted to skip categories to make your numbers look better—you're only hurting your own decision-making.

Crafting the Core Formula

With your data neatly organized, the actual formula is refreshingly simple. In your Calculation Tab, click an empty cell and type the following. This assumes your costs are in cells B2 through B5 and your new customer count is in cell B6 on your "Inputs" sheet:

=SUM(Inputs!B2:B5) / Inputs!B6

Let's quickly break that down:

SUM(Inputs!B2:B5)simply adds up all your sales and marketing expenses from the Inputs tab.- The

/is just the division symbol. Inputs!B6points to the cell where you logged the number of new customers.

That's it. The result is your blended CAC for that time period.

For anyone working with more complex datasets spread across different files, you might need to combine information first. If you need a refresher, our guide on how to merge in Excel is a clear walkthrough.

Isolating Costs by Channel

A blended CAC is your starting point, but the real, game-changing insights come from calculating it on a per-channel basis.

This is where you see what’s really working.

To do this, just expand your Inputs sheet. Instead of one column for "Ad Spend," create separate columns for "Google Ads Spend," "Content Marketing Costs," or "LinkedIn Outreach Tools."

Then, you can create separate CAC formulas for each channel. Your Google Ads CAC, for example, would only sum the costs directly tied to that channel (ad spend, any specific agency management fees) and divide it by the customers you know came from those ads.

This granular view is powerful. It shows you which channels are your true growth engines and which ones are just draining your budget with little to show for it. After building your calculator, understanding its full potential is key to driving growth. Learn more about how to use a Customer Acquisition Cost Calculator to see how this tool can directly impact your business strategy.

Turning Your CAC Into Smarter Marketing Decisions

Having a number in a spreadsheet is one thing; using it to actually grow your business is another entirely. A calculated CAC is just data. An interpreted CAC is the foundation for a smarter, more profitable marketing strategy.

This is the shift from just spending money to strategically investing it.

The first step? Give your CAC some much-needed context. By itself, a CAC of $500 is meaningless. Is that good? Terrible? Who knows. The answer comes from pairing it with a customer's lifetime value (LTV)—the total revenue you expect from a single customer over their entire relationship with you.

The Gold Standard: Your LTV to CAC Ratio

The LTV to CAC ratio is the true health check for your business model. It tells you exactly how much return you're getting on every dollar you spend to bring a new customer in the door.

For most B2B agencies and SaaS companies, the widely accepted benchmark for a sustainable business is a 3:1 ratio. This means for every $1 you spend on acquisition, you get $3 back in lifetime revenue.

- A 1:1 ratio means you're just breaking even on each customer. Once you add in operational costs, you're on a fast track to going out of business.

- A ratio below 3:1 is a warning sign. You might be overspending on acquisition, or you need to work on customer retention to boost that LTV.

- A ratio of 4:1 or higher is fantastic. It signals that you have a very efficient growth engine and likely have room to invest more aggressively to capture the market.

Figuring this out is a huge part of learning how to measure marketing ROI the right way. CAC is a cost metric, but the LTV:CAC ratio turns it into a powerful indicator of profitability and growth.

A high CAC isn't automatically bad if it's paired with an even higher LTV. The goal isn't the lowest possible CAC; it's the most profitable LTV to CAC ratio.

Translating CAC into Actionable Strategy

Your CAC data should directly inform where your budget goes. If you see a high CAC, it's a signal to start digging. Is it because you’re pushing into a new, more competitive market, or is a specific channel just not pulling its weight?

On the flip side, a low CAC on a particular channel is a green light. It’s a data-backed reason to double down and scale your investment there. For a B2B agency, this might mean shifting budget from broad LinkedIn ads to a more targeted content strategy if the numbers show a much better return.

This data also becomes your best friend when it's time to justify budgets. Instead of asking for more money based on a hunch, you can build a rock-solid case: "Our data shows that every $100 we spend on Google Ads brings in a customer worth $400. We want to increase our ad spend to accelerate this profitable growth."

It’s also crucial to remember that CAC isn't a universal constant; it varies wildly. Fintech and enterprise SaaS can have CACs in the thousands, while e-commerce businesses might average around $68–$78. Even within the same industry, performance can be all over the map, which just highlights how much your own strategy matters. Knowing the average customer acquisition costs by industry helps you set realistic benchmarks and guides everything from your pricing models to your retention efforts.

Uncovering Deeper Insights with Advanced CAC Analysis

A blended CAC gives you a bird's-eye view, but the real power comes from digging deeper. This is where your customer acquisition cost calculator goes from a simple reporting tool to a strategic weapon. Advanced analysis is how you find the why behind the numbers and pinpoint your most efficient growth levers.

The first move is to ditch the single, blended CAC and start tracking a channel-specific one. This means isolating the costs and customers for each of your marketing efforts, like Google Ads, content marketing, or direct outreach.

The insights here can be shocking. You might find your high-volume Google Ads campaign has a CAC of $450, while your slower-burn content marketing brings in customers for just $150.

Without this granular view, you’re flying blind and likely pouring money into channels that are secretly killing your profitability. Keeping all these initiatives organized is much easier with a project management tool.

Attributing Paid vs Organic Costs

A common headache is trying to separate costs between paid and organic channels. One simple but effective way to start is the 'Primary Channel Attribution' model.

Here’s how it works: if a customer first finds you through a paid ad but later converts through an organic search, you attribute the full acquisition cost to that initial paid touchpoint.

It's not perfect, but this model gives you a clear baseline for understanding how your paid efforts are seeding future organic conversions. It also stops you from making the classic mistake of thinking organic channels are "free"—they're not, once you factor in content creation and SEO tool costs.

A critical metric for sustainable growth is the CAC Payback Period. This isn't just about what a customer costs to acquire; it's about how quickly you get that money back.

Calculating Your CAC Payback Period

The CAC Payback Period measures how many months it takes for the profit from a new customer to cover their acquisition cost. This is a vital health metric for any business with recurring revenue because it has a direct impact on cash flow.

To figure it out, just divide your CAC by the average monthly recurring revenue (MRR) per customer, multiplied by your gross margin percentage.

Formula: CAC / (MRR per Customer * Gross Margin %) = Payback Period in Months

Let's say your CAC is $600, your average MRR is $100, and your gross margin is 80%. Your payback period would be 7.5 months ($600 / ($100 * 0.80)).

The goal is to get that number as low as possible. A shorter payback period means a healthier, more self-sustaining business.

Once you have your CAC dialed in, you can start modeling different scenarios. A great next step is to learn how to perform sensitivity analysis to see how changes in key assumptions impact your strategy. This kind of advanced modeling is directly tied to a customer's long-term financial impact, so check out our guide on improving customer lifetime value for more strategies.

Common Questions We Hear About CAC

Even with a perfect calculator, you'll still have questions. That's normal. Getting straight answers is what builds confidence in your numbers and helps you make good decisions. Here are some of the most common things people ask when they start tracking customer acquisition cost.

How Often Should I Calculate My CAC?

For most businesses, calculating CAC monthly is the sweet spot.

It’s frequent enough to catch trends early and adjust your spending, but not so frequent that a few slow days throw your numbers into chaos. Trying to calculate it daily or weekly often just leads to noise—you're reacting to random blips instead of real patterns.

On top of that, a quarterly review is a smart move for bigger-picture planning. It lets you zoom out and see how your marketing efforts are really performing over time, smoothing out any weird spikes or dips from a single month.

What Is a Good LTV to CAC Ratio?

A healthy LTV to CAC ratio is widely considered to be 3:1. Think of this as the gold standard. It’s a clear sign you have a profitable and scalable business model.

In simple terms, a 3:1 ratio means that for every dollar you spend to acquire a customer, you get three dollars back over their lifetime.

If your ratio is 1:1, you're just breaking even on the acquisition cost, which isn't sustainable once you add in all your other operational expenses. For a B2B agency or SaaS business, hitting that 3:1 mark or better is a powerful signal that your growth engine is working. You can manage your sales and marketing workflows to keep this ratio healthy with a tool like Airslate.

How Should I Treat Freemium or Trial Users in My CAC Calculation?

This is a critical question, and getting it wrong can completely warp your numbers.

The rule is simple: only count a customer as 'acquired' once they start paying you. Someone who signs up for a free trial is a lead, not a customer.

Your total marketing and sales costs should absolutely include everything you spent to get both free and paid users in the door. But the "New Customers" part of your formula—the denominator—must only include people who converted to a paid plan during that time.

This discipline keeps your calculator focused on the true cost of acquiring a paying customer. It stops you from getting artificially low CAC numbers that look great on paper but hide a leaky funnel. And once those customers are ready to sign, a service like Sign now can help you get those new contracts and agreements sorted out smoothly.